Latest Trending Blogs

Find the latest updates and expert advice on the best properties in India. Filter out the deals that are shady. Know how to find the best property offers around you.

Blogs

Marketing methods for selling a home are critical tools for anyone trying to stand out in a competitive real estate market. Using a range of strategies not only improves your property's visibility, but it also raises your chances of attracting serious purchasers rapidly. Let's look at efficient marketing methods that can help you promote your home's best characteristics, reach a larger audience, and accomplish a successful sale. Professional Photography Professional photography is an excellent marketing strategy for selling a home. High-quality photography is essential when selling a home. Listing photos frequently serv...

When you first move into a new home, it's normal to want to personalize the space - after all, unless you built your dream home, the finishes, fixtures, and paint colors were most likely picked by the previous owner. So, where to start? Here are ten projects, both little and major, that will help make your house seem more like home. 1. Paint the front door to Personalize Your New HomeIt requires significantly less commitment than painting the exterior and provides more bang for the buck. While choosing a paint color, think about updating the hardware as well – shiny new hardware may give your property a new look, an...

The saying "Success comes to those who work" is ideally suited for Gautam Adani, the richest man in India. After leaving college, he is currently the richest person in India. The billionaire is a member of the 1%club and is the richest person in the nation. The millionaire has just become one of the world's ten richest people. by moving up to the tenth position, surpassing the previous richest Indian, Mukesh Ambani. A luxury lifestyle is only natural to accompany a massive financial balance. It is impossible to ignore the reality that billionaires tend to have unique homes when discussing them. So let's have a look at some o...

Banks offer home loans to salaried and self-employed people for the purpose of purchasing land for a house, purchasing already-built homes, or renovating already-existing homes. These loans have an additional rate of interest (ROI) on the premium amount when the equivalent monthly payment (EMI) starts. You must consider additional interest rates on the lump sum advance of funds in order to assess your ability to repay a house loan. Obtaining a competitive interest rate on the borrowed amount is dependent on a number of factors, including your income, credit score, loan amount, repayment period, and bank connection.Most ...

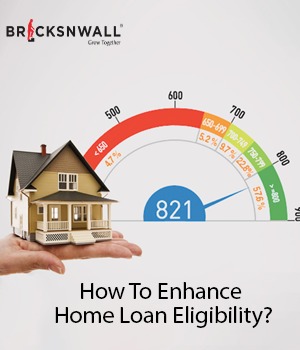

Need a home loan and have a low CIBIL score? This is what you should do." Low CIBIL Score": How Low Is It?A low CIBIL score doesn't have a set description. Each lender may have different eligibility conditions for CIBIL scores.Banks must have a minimal CIBIL score of 700–750 to authorize a home loan. While different banks may have different conditions for a minimal score, most Indian banks need a minimum of 700. A person who scores between 700 and 750 on the CIBIL is regarded as the least likely to be approved for a home loan.Banks view borrowers with credit scores between 650 and 700 as relatively parlous, and they may be ...

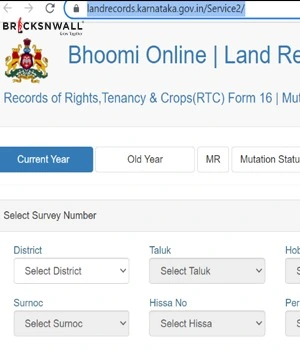

The Revenue Department, Government of Karnataka, created all online land records through the Bhoomi Portal in 2000. All land-related information such as rights, rent, and crop records (RTC), or Pahani transfer records were digitized and made available to citizens or farmers kiosks. All plots can be created digitally using the income statement available on the Bhoomi Portal. In this article, you can get RTC, MR, etc. from the Bhoomi portal. We will understand the process of getting documents online. Bhoomi – Karnataka Online Land RecordsBhoomi (meaning land) is an online portal for submitting land records in Karnataka. The lau...

Make your own comfortable and peaceful place of worship by drawing inspiration from these gorgeous puja room designs. See our handpicked collection to learn more about the many traditional pooja room designs.In Indian households, a traditional pooja room is a room set aside for prayer and meditation. This place of worship should be situated in the northeastern corner of a house when created, according to Vastu. Motivated by devotion, a pooja room should gracefully exude warmth and tranquility. In addition, you can elevate classic pooja room ideas beyond typical home décor accessories to achieve mental and spiritual calm.Whether you...

Banks and non-banking financing organizations (NBFCs) both offer house loans. NBFCs include Housing Finance Companies (HFCs). By contrasting the duration, interest rate, and processing costs of each offer, you can decide between a bank and an HFC. Here are some of the best house finance companies in the nation.Top Indian Housing Finance Companies ListHousing Finance from HDFCAmong the many house loan choices that HDFC Housing Finance provides are loans for plots of land, loans for rural homes, loans for home modifications, and loans for home additions. A mortgage's initial interest rate is 8.65%. Salary- and self-em...

A successful home loan agreement enables you to buy the home you have always wanted without having to stay for a long time before you can save up enough capital to make the complete payment. You can get a home loan for sometimes, indeed, 90 percent of the requested value of the property under consideration. Before you can get a home loan, you need to sign a home loan agreement. This document contains tenure-term stipulations under which you're agreeing to get the loan and the creditor is agreeing to pay. The contract is to be inked by all the involved stakeholders; dereliction instructions may be included in a home loan agre...

When you decide to apply for a Home loan, you will encounter multitudinous questions. Another question, analogous as from which bank to borrow capitalist, how to get a loan cheaper, is how important to borrow. generally, when buying a house, a person pays a part of the total down payment, and the rest is paid by taking a home loan. Assume the house you wish to buy costs Rs. 50 lakh. Let's say you made a down payment of rupees 8 lakh and got a home loan of Rs. 4.2 lakh more from the bank. Still, you are not demanded to gain the demanded credit. Everyone who applies for a loan has certain conditi...