Detail about Fake Rent receipt and its consequences

Bricksnwall Trusted Experts

What are receipts for rent?

Rent receipts serve as documentation that the

renter paid the landlord's rent. These also serve as documentation for tax

deductions against the HRA portion of your pay. But in the recent past, a

lot of incidents have been documented in which employees fabricate rent

receipts in order to claim the HRA benefit. Serious legal repercussions may

arise from this manipulation.

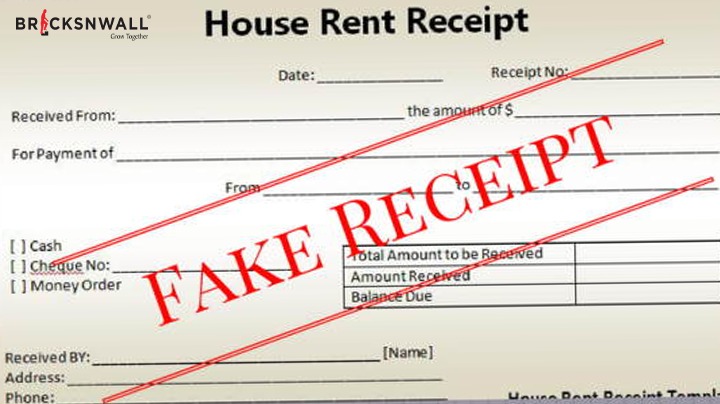

What are fake rent receipts?

The IT Act of 1961 states that employer-provided

HRA is not taxable as long as it falls within an applicable ceiling that is

determined by adding the employee's real rent payment to their base wage.

Consequently, HRA greatly reduces the employees' effective tax outflow. Even

when they own their own homes, some people fabricate or falsify rent agreements

and receipts in order to receive the HRA benefit.

How to create a fake rent receipt

Sometimes, tenants may create false rent receipts

by filling up rent details in a rent receipt template or by using online rent

receipt generators. They would then sign the document in the name of a

fictitious landlord and present it as an authentic receipt.

Employees who own their own homes occasionally give

their close relatives, such as their brother or sister, the rent receipt in

order to claim the HRA benefit. It is legal to claim the HRA deduction in this

situation, provided that you pay your parents or other relatives' rent and

they pay income tax on the rental income they receive.

If the rent payment exceeds Rs 1 lakh per annum,

the landlord's PAN number must also be included on the rent receipt. People

who use fictitious rent receipts frequently fail to disclose the PAN number or

mention it incorrectly, which is discovered during verification.

Employees who own a home in the same city

occasionally provide the rent receipt in order to claim HRA exemption and

calculation.

At the moment, there is no legal restriction on

renting out a person's parents' or relatives' home. Providing pertinent

documentation supporting the requested tax exemption is required. To obtain HRA

benefits, many workers, however, falsify the rental agreement and rent receipt.

Penalties for producing fictitious rent receipts

The income tax department uses technology to keep

an eye on your files and will promptly send you a legal letter requesting

additional documentation if you claim any questionable deductions.

The claimed exemption will not be allowed by the

taxman if you do not provide any proof. However, underreporting or misreporting

revenue will result in penalties if the IT department determines that your

claims are fraudulent.

False rent receipts could result in very harsh

penalties and major problems for employees. Let's investigate the numerous

penalties for fabricating a rent receipt.

Depending on the type of forgery and the amount of

rent, different penalties apply for making a fake rent receipt. The following

are some examples of penalties for forging false rent receipts:

Notice of legal action

In the event of a data discrepancy, the department

may cancel the HRA exemption, start an investigation, or send out a

notification requesting appropriate documentation.

Tenant facing a penalty of up to 50%

If the assessee underreports their income, the assessing

officer may apply a penalty of fifty percent (50%) under Section 270A of the

I-T Act, 1961. This applies to someone who knowingly provides false invoices or

receipts in order to falsely report their income. In addition, interest is due

under the Income Tax Act's sections 234A, 234B, and 234C.

Penalties for underreporting income might reach

200%.

The department has the authority to impose a

penalty of up to 200% of the tax that would have applied to underreported

income.

What qualifies as underreporting income?

An individual is thought to have underreported

their income if:

- The

income determined in the return processed under Clause (a) of Sub-section

(1) of Section 143 is less than the income assessed.

- When

no income return is submitted, the assessed income exceeds the maximum

amount that is not subject to taxation.

- The

income that was reassessed is higher than the income that was evaluated or

reassessed right before it was done.

- The

presumed total income ascertained in the return processed under Clause (a)

of Sub-Section (1) of Section 143 is less than the amount of deemed total

income assessed or reassessed in accordance with the provisions of Section

115JB or Section 115JC.

- When

no income return has been submitted, the amount of presumed total income

as determined by Section 115JB or Section 115JC is larger than the maximum

amount not subject to taxation.

- The

considered total income assessed or reassessed immediately prior to such

reassessment is less than the amount of deemed total income reassessed in

accordance with the provisions of Section 115JB or Section 115JC.

- Reassessed

or evaluated revenue has the effect of offsetting loss or turning loss

into income.

What does it mean to misreport income?

One of the following scenarios could include income

misreporting:

- falsifying

information or omitting facts

- Neglecting

to enter investments in the accounting records

- Unsupported

spending claim with no supporting documentation

- recording

any fraudulent entry in the accounting records

- Not

entering any receipt that affects overall income in the books of account

- Not

reporting any foreign transaction, any transaction that is assumed to be

foreign, or any designated domestic transaction

Things to remember in order to escape charges for

falsifying a rent receipt

The following are crucial considerations to make in

order to avoid charges for forging rent receipts:

- Obtain

a legitimate lease from the landlord.

- Consider

paying your rent by check or online.

- If

the annual rent payment exceeds Rs 1 lakh, obtain the landlord's PAN

information as shown on the rent receipt.

- Tenants

must maintain a record of the utility bills they have paid.

- Together

with a properly completed Form 60, a declaration stating that the landlord

does not own a PAN must be obtained.

- If a

close relative provides the rent receipt, they should disclose the

specifics of the rent.